|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Cash Out Refinance Investment Property Rates and Their ImplicationsCash out refinance investment property rates can significantly impact your financial strategy. Knowing these rates and how they work is crucial for property investors. This article delves into what to expect and how to make informed decisions. What is a Cash Out Refinance?A cash out refinance replaces your existing mortgage with a new one, typically with a higher loan amount. The difference is paid out to you in cash. This can be an effective way to access capital for further investments or property improvements. Benefits of Cash Out Refinance

Risks InvolvedWhile there are benefits, there are also risks to consider:

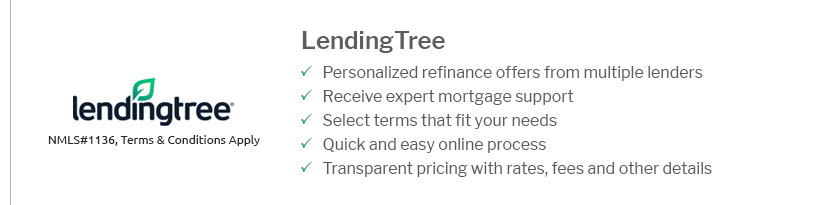

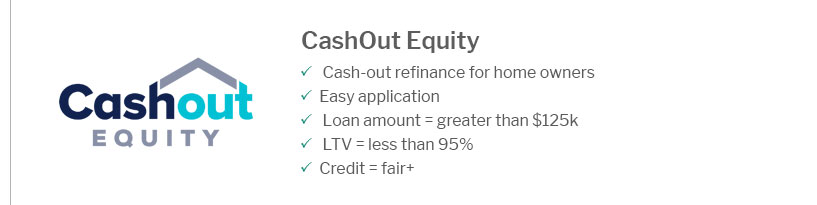

Factors Affecting Refinance RatesVarious factors influence refinance rates for investment properties, including: Market ConditionsInterest rates fluctuate based on economic conditions. Keeping an eye on trends can help you decide the best time to refinance. Credit ScoreYour credit score plays a significant role in determining your refinance rate. A higher score can lead to better terms. Property Type and Loan AmountThe type of investment property and the amount you wish to refinance can also affect rates. Larger loans or riskier property types may have higher rates. For a comprehensive comparison, consider evaluating your options through resources like an fha loan to conventional loan refinance tool. Comparing Popular Refinance OptionsWhen considering a refinance, it's crucial to compare different loan products and their rates. Fixed vs. Variable RatesFixed rates offer stability with consistent payments, while variable rates might offer lower initial rates but come with the risk of future increases. Government-backed LoansOptions like FHA loans might be worth exploring. Use an fha simple refinance calculator to understand potential costs and savings. FAQs About Cash Out Refinance Investment Property RatesWhat are the typical closing costs for a cash out refinance?Closing costs can range from 2% to 5% of the loan amount. These costs include appraisal fees, origination fees, and title insurance. Can I refinance with a low credit score?While possible, a low credit score may result in higher interest rates and fewer loan options. Improving your credit score can lead to better terms. How does a cash out refinance affect taxes?The interest on the refinanced loan may be tax-deductible if the funds are used for home improvements, but it’s best to consult with a tax advisor. https://themortgagereports.com/25521/cash-out-refinance-rental-property-guidelines-mortgage-rates

A cash-out refinance on an investment property allows you to replace your existing mortgage with a new, larger loan, providing you with a lump sum of cash. https://www.credible.com/mortgage/refinance/rates/cash-out-refinance

Check cash-out fixed refinance rates. Then personalize them. Your refinance rate depends on your credit score and other details. https://www.citizensbank.com/learning/refinancing-investment-property.aspx

Once you've accumulated equity in the property by paying the mortgage on time for several years, you can refinance for more than you owe on the property. The ...

|

|---|